Depreciation Of Office Improvements . Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. When you pay for leasehold improvements, capitalize them if they exceed. Depreciation is the systematic allocation. All leasehold improvement assets must be depreciated, so that the. Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life.

from www.slideserve.com

All leasehold improvement assets must be depreciated, so that the. Depreciation is the systematic allocation. When you pay for leasehold improvements, capitalize them if they exceed. Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value.

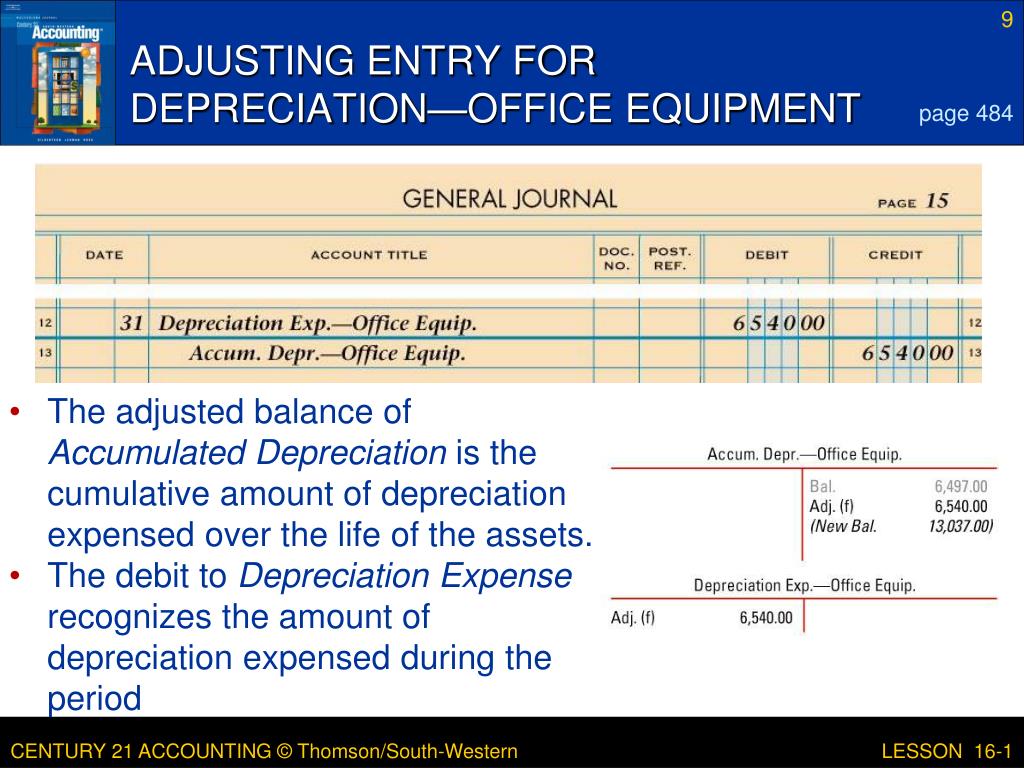

PPT LESSON 161 PowerPoint Presentation, free download ID5762509

Depreciation Of Office Improvements All leasehold improvement assets must be depreciated, so that the. Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. Depreciation is the systematic allocation. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life. When you pay for leasehold improvements, capitalize them if they exceed. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. All leasehold improvement assets must be depreciated, so that the.

From accounting-services.net

Depreciation Recapture Definition ⋆ Accounting Services Depreciation Of Office Improvements When you pay for leasehold improvements, capitalize them if they exceed. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. All leasehold improvement assets must be depreciated, so that the. Depreciation is the systematic allocation. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be. Depreciation Of Office Improvements.

From www.scribd.com

Depreciation PDF Depreciation Expense Depreciation Of Office Improvements Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. All leasehold improvement assets must be depreciated, so that the. When you pay for leasehold improvements, capitalize them if they exceed. Depreciation is. Depreciation Of Office Improvements.

From www.chegg.com

Solved Chapter 10 Serial Problem Part 1 Annual Depreciation Depreciation Of Office Improvements All leasehold improvement assets must be depreciated, so that the. When you pay for leasehold improvements, capitalize them if they exceed. Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Depreciation is. Depreciation Of Office Improvements.

From www.investopedia.com

What Is Property, Plant, and Equipment (PP&E)? Depreciation Of Office Improvements When you pay for leasehold improvements, capitalize them if they exceed. Depreciation is the systematic allocation. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life. Depreciation → the capitalized costs. Depreciation Of Office Improvements.

From www.chegg.com

Solved At December 31, 2023, Cord Company's plant asset and Depreciation Of Office Improvements All leasehold improvement assets must be depreciated, so that the. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. When you pay for leasehold improvements, capitalize them if they exceed.. Depreciation Of Office Improvements.

From www.slideshare.net

Depreciation Depreciation Of Office Improvements All leasehold improvement assets must be depreciated, so that the. When you pay for leasehold improvements, capitalize them if they exceed. Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful. Depreciation Of Office Improvements.

From www.journalofaccountancy.com

8 ways to calculate depreciation in Excel Journal of Accountancy Depreciation Of Office Improvements Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life. When you pay for leasehold improvements, capitalize them if they exceed. Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. All leasehold improvement assets must be depreciated, so that. Depreciation Of Office Improvements.

From www.youtube.com

How to Prepare Office Equipment Account? Fixed [noncurrent] Asset Depreciation Of Office Improvements Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. All leasehold improvement assets must be depreciated, so that the. When you pay for leasehold improvements, capitalize them if they exceed. Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. Depreciation is. Depreciation Of Office Improvements.

From einvestingforbeginners.com

Is Depreciation an Expense? Is EBITDA Deceitful? Well, it Depends Depreciation Of Office Improvements Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Depreciation is the systematic allocation. Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. When you pay for leasehold improvements, capitalize them if they exceed. All leasehold improvement assets must be depreciated,. Depreciation Of Office Improvements.

From www.slideserve.com

PPT LESSON 161 PowerPoint Presentation, free download ID5762509 Depreciation Of Office Improvements Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. When you pay for leasehold improvements, capitalize them if they exceed. All leasehold improvement assets must be depreciated, so that the. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful. Depreciation Of Office Improvements.

From www.template.net

Accounting Depreciation Impact Analysis Template Edit Online Depreciation Of Office Improvements All leasehold improvement assets must be depreciated, so that the. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life. Depreciation → the capitalized costs of the leasehold improvements are depreciated. Depreciation Of Office Improvements.

From www.resnooze.com

Carpet Depreciation Calculator Depreciation Of Office Improvements Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. When you pay for leasehold improvements, capitalize them if they exceed. Depreciation → the capitalized costs of the leasehold improvements are. Depreciation Of Office Improvements.

From synder.com

Depreciation of Assets What Asset Cannot Be Depreciated? Depreciation Of Office Improvements Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life. Depreciation is the systematic allocation. When you pay for leasehold improvements, capitalize them if they exceed. All leasehold improvement assets must be depreciated, so that the. Depreciation → the capitalized costs of the leasehold improvements are depreciated over the. Depreciation Of Office Improvements.

From www.vertex42.com

Depreciation Schedule Template for StraightLine and Declining Balance Depreciation Of Office Improvements Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. Depreciation is the systematic allocation. When you pay for leasehold improvements, capitalize them if they exceed. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life. Depreciable amount is the. Depreciation Of Office Improvements.

From old.sermitsiaq.ag

Excel Depreciation Template Depreciation Of Office Improvements When you pay for leasehold improvements, capitalize them if they exceed. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life. All leasehold improvement assets must be depreciated, so that the. Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful. Depreciation Of Office Improvements.

From www.fastcapital360.com

How to Calculate MACRS Depreciation, When & Why Depreciation Of Office Improvements Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. All leasehold improvement assets must be depreciated, so that the. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. When you pay for leasehold improvements, capitalize them if they exceed. Depreciation is. Depreciation Of Office Improvements.

From slidesdocs.com

Office Equipment Depreciation Value Excel Template And Google Sheets Depreciation Of Office Improvements All leasehold improvement assets must be depreciated, so that the. Depreciation is the systematic allocation. Depreciation → the capitalized costs of the leasehold improvements are depreciated over the shorter of 1) the useful life. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life. Depreciable amount is the cost. Depreciation Of Office Improvements.

From haipernews.com

How To Calculate Depreciation Leasehold Haiper Depreciation Of Office Improvements When you pay for leasehold improvements, capitalize them if they exceed. Paragraph 50 of ias 16 requires an item of property, plant and equipment (asset) to be depreciated over its useful life. Depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Depreciation → the capitalized costs of the leasehold improvements are. Depreciation Of Office Improvements.